Family wealth office

Estate Planning and Tax OptimizationRunning your family’s finances through a business entity makes a lot of sense in many countries. Business entities can be created in any jurisdiction you desire and are typically taxed at lower rates. This course will suggest practiced methods of varying degrees of difficulty to optimize your income and taxes.

Money often costs too much.

Ralph Waldo Emerson

Where the income is made

In any situation, location is crucial.

Gordon Ramsay

Have you ever stopped to think about where you are working? Maybe it used to be in an office building. Perhaps a warehouse. For some lucky folks their workplace might be a lawn chair in the sun.

More specific. Think about the city, county, region, province, and country where you work; at each layer taxes will be imposed to fund services. In the past, when people rarely moved (even across a town), the products of their work touched their neighbors, but that was about it. In the present, the products of my work can touch someone not even on this planet; of course astronauts have Internet access!

With work much less location dependent, how we think about our residency might change too. If I spend most of my time in a particular place (the Denver metro area) that’s easy, but what if I split my time working in a coworking space in Calgary, a townhome in Buenos Aires, and a cabin in Pagosa Springs; each place has different rules about what kinds of work is taxed, and how much those taxes might be. It gets even more complicated thinking about the situation where the means of production (solar panels, land, crops) are managed from several thousand miles away. Certainly one can say I do some of the work from my cabin, but to what government should I pay taxes for money my solar panels generate by selling electricity to a utility in another state?

Enter tax arbitrage: profiting from differences in how income and transactions are taxed in different jurisdictions.

In this first section we will explore the best tax jurisdictions for keeping as much of your income as possible.

US Territories

Most US Territories offer heavy tax incentives to businesses (and people) to relocate to their island shores, but beware if you still reside within a US State! You will be hit with additional penalties for owning or receiving income from a “controlled foreign corporation” and you would be just as well served to create your “foreign corporation” in a truly zero tax foreign location. With spotty internet access and irregular flights; a business could be difficult to run remotely. If it makes you feel any better though, you only pay to the respective territory treasury and never the US IRS.

- Puerto Rico offers a tax rate of 4% for export companies

- Guam will offer a 75% rebate for certain industries, assuming you invest at least $10,000: https://www.investguam.com/business-in-guam/investor-incentives/

- US Virgin Islands offers 90% income tax rebates if you employ 10 people and invest $100,000: https://www.usvieda.org/incentives/edc-program

From: https://commons.wikimedia.org/wiki/File:US_insular_areas.svg

US States

Certain states have no or low sales taxes, while other states have no or low income taxes. For our purposes we want to find jurisdictions that have the lowest income taxes, but are still relatively easy to do business in (reasonable filling fees, online services, responsive officials). This new family wealth office won’t be selling anything, but it will be earning plenty of income!

From investment management to charitable giving advice, family offices offer a total financial solution. In addition, the family office can also handle non-financial issues, such as private schooling, travel arrangements, and miscellaneous other household arrangements.

What Are Family Offices? – https://www.investopedia.com/terms/f/family-offices.asp

When thinking about managing your household’s money, you will be running the family office and also be the beneficiary of its services. This will come in handy later when we talk about potential tax deductions.

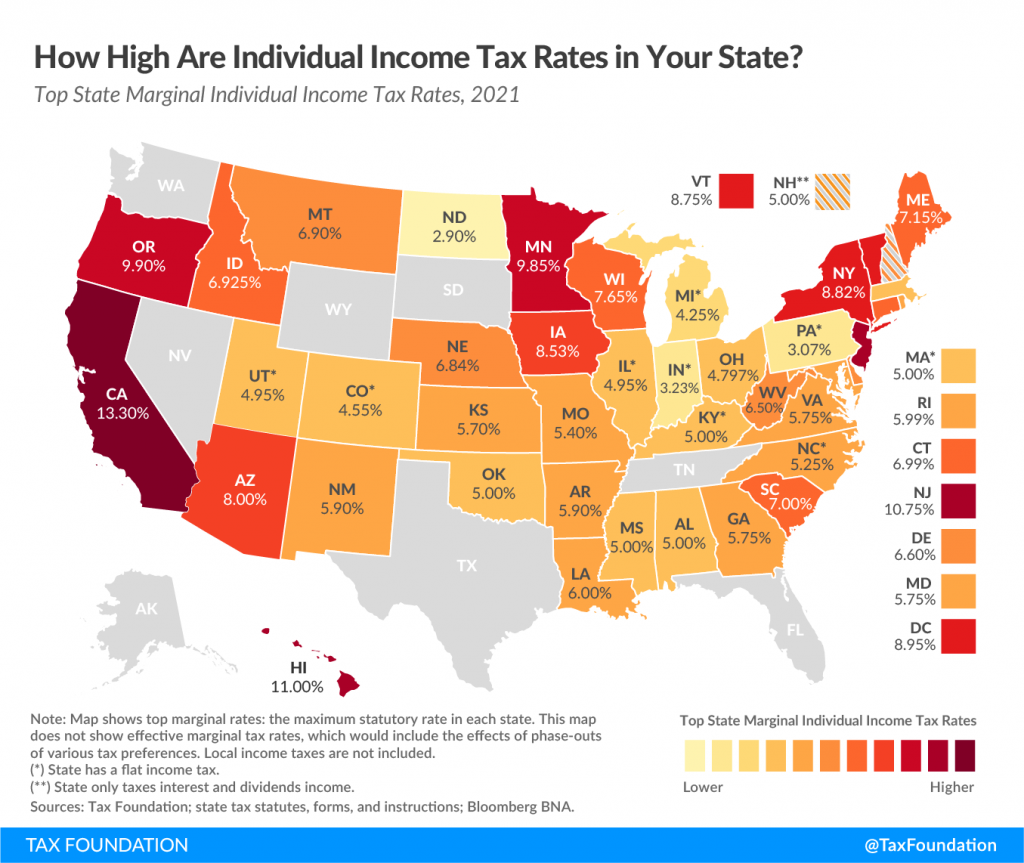

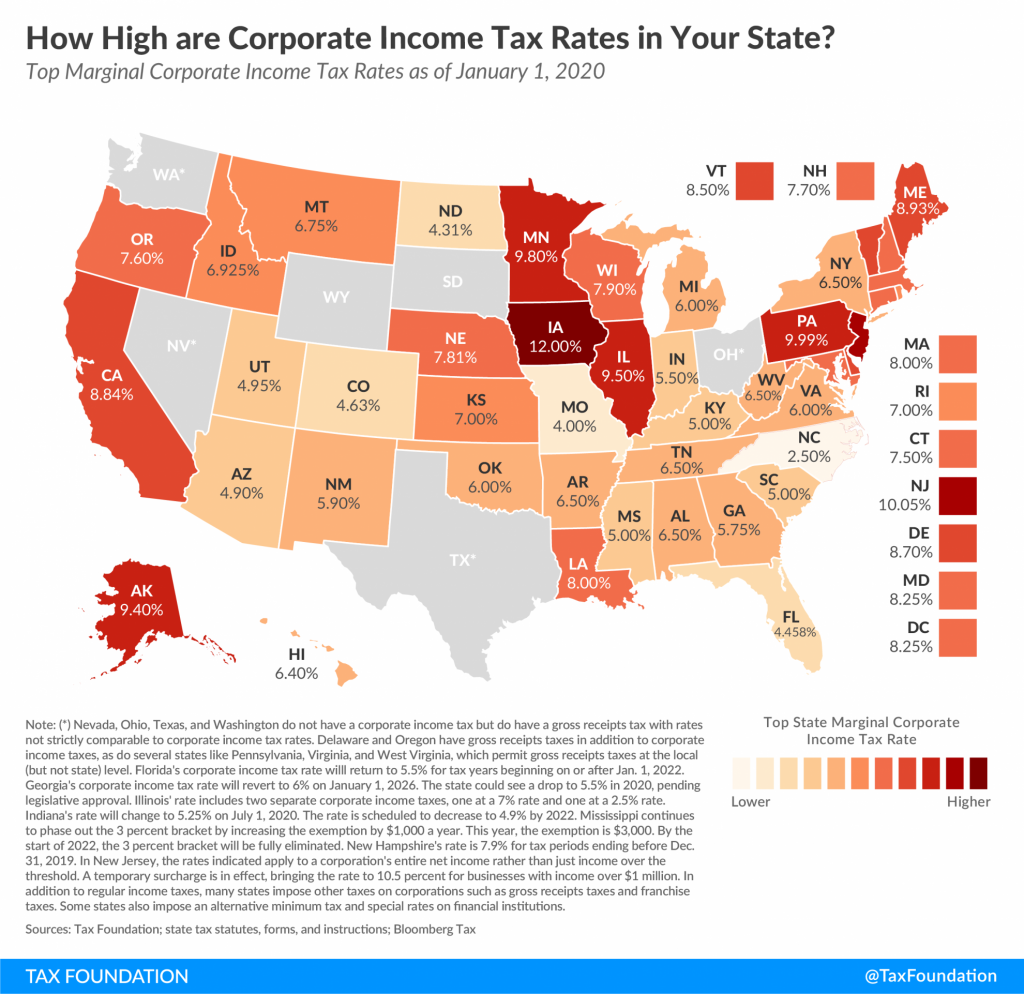

Low income tax US states

There are only two states in the US which do not levy corporate income tax, individual income tax, nor gross receipts taxes: South Dakota and Wyoming. South Dakota has some of the highest filling fees I have ever seen outside of Nevada. Wyoming has fees on the higher side, but you’re paying for lower taxes, right? Both have navigable and responsive secretary of state websites for easy online filing.

Watch out for states with gross receipts taxes! They tend to have all manner of business licenses at the state, county, and local levels you will have to comply with too. Nevada is the prime example: a few hundred dollars at just about every level of government adds up!

Compare that to Wyoming which has no state level business license fee, no annual list filing fee, and very few local municipal business licenses to be sorted through, which are usually limited to certain controlled industries.

There are a few states with flat corporate and individual income tax rates below 5%: Colorado, Florida, North Dakota, and Utah. I’m not going to bother with Florida since it will be underwater in 20 years. North Dakota’s online business filing fees are on the higher side. Utah has slightly higher fees than Colorado’s filing fees.

Taken from https://taxfoundation.org/publications/state-individual-income-tax-rates-and-brackets/

Taken from https://taxfoundation.org/state-corporate-income-tax-rates-brackets-2020/

Conclusions

If you are looking for a state with no taxes, then pick Wyoming; generally they are going to be very hands off.

If you want a progressive state with low taxes, Colorado is the right place to locate; government services are great for what you pay.

Canada

Every Canadian province and territory has income and sales tax. But as we discussed in the previous section, there are always ways to optimize for the intersection of income tax, investment goals, family needs, and DIY options. If you can save a percent or two on income tax, but it is a real pain to manage the legal requirements … is it worth it? Why create a business in a region which will be more unstable due to climate change? For my risk/reward profile, interior British Columbia made the most sense for my headquarters.

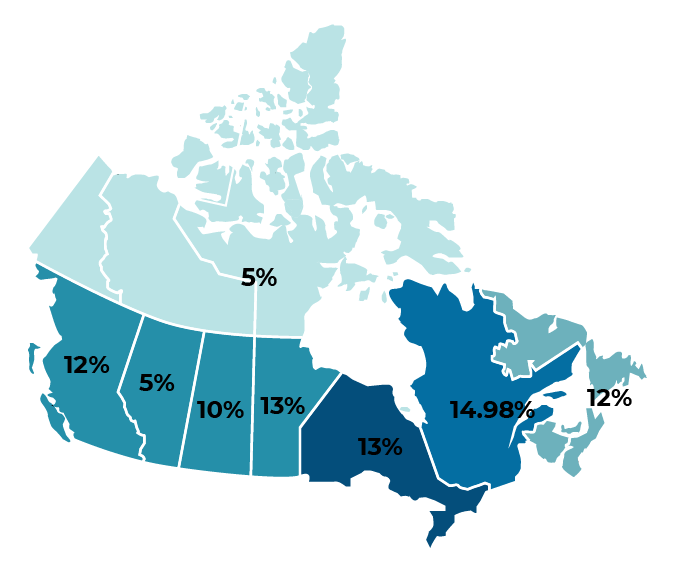

Sales Tax

On the sales tax side, the province of Alberta, and the territories of Yukon, Nunavut, and Northwest Territories, are the places where you will only pay the 5% GST to the national government. Moral of the story: purchase your goods in those locations.

From https://www.transfereaserelocation.com/canada-which-region-has-the-lowest-tax-rate/

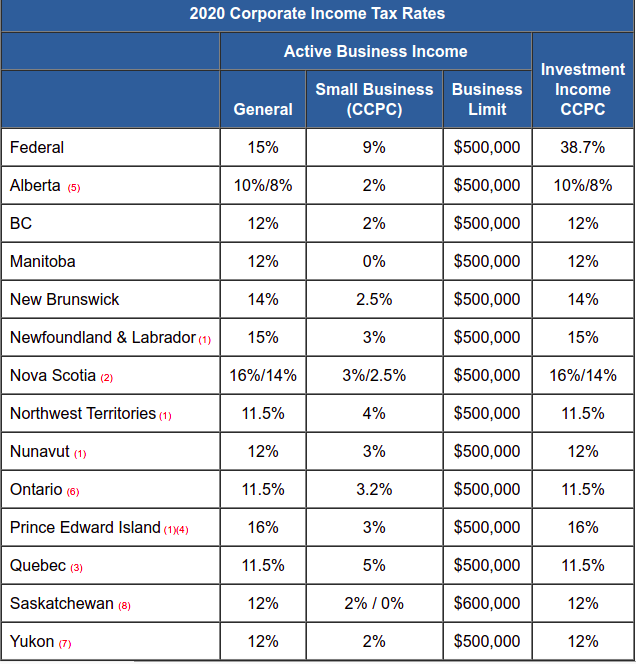

Corporate income tax

Compared with other regions, Canada allows fewer loopholes when it comes to passive income. Investment income is taxed at a significantly higher national rate and is specifically defined as income from property:

A specified investment business is carried on by a corporation whose principal purpose is to derive income (interest, rent, dividends and royalties) from property, unless the business employs more than 5 full time employees. Income from property would include rental or leasing income from land or buildings, but would exclude income from renting or leasing moveable property such as machinery and equipment.

https://accountingottawa.com/active-business-income-small-business-deduction/

From https://www.taxtips.ca/smallbusiness/corporatetax/corporate-tax-rates-2020.htm

And there is no way to shield your passive income streams by bundling them into a business entity with some or most of its income coming from active sources (unless you have 5 employees or could employ 5 employees).

Personal income tax

The great thing about creating a corporation is that the business entity can retain earnings to keep your personal income tax rate low (by only paying dividends when you need the cash). Or your corporation can be taxed in a jurisdiction separate from your personal income. Like corporate tax rates, the territories have the lowest personal tax rates: https://www.canada.ca/en/revenue-agency/services/tax/individuals/frequently-asked-questions-individuals/canadian-income-tax-rates-individuals-current-previous-years.html#provincial

Conclusions

If you are looking for a province which prides itself on pushing income taxes as low as possible, and other sorts of “business friendly” decisions including allowing foreigners to run their own company, choose Alberta. For the DIYers, watch out, you cannot file directly, you have to go through a service provider: https://www.alberta.ca/incorporate-alberta-corporation.aspx

For a provincial home offering a balance of lower taxes, better services, relaxed director requirements, and automated services, make your base in British Columbia.

Or do what I do and have an entity domiciled and registered, 350CAD registration and 45CAD renewal, in British Columbia, with a location in Alberta as well. Alberta has an automated and cheap (14CAD) online registration to support businesses under the New West Partnership Trade Agreement. You pay income tax on where the money is made. Compare that to direct registration in Alberta which costs 300-500CAD registration and 70-90CAD a year in renewal fees depending on which service provider you find.

Be sure to use BizPal for a comprehensive list of licenses you may need.

Outside of Northern America

Significant international tax arbitrage is outside of the scope of this course, and may be covered in another, more advanced course. In the meantime a few tips for doing business outside of Northern America.

For the Canada Revenue Agency:

- If you file an income tax return with the CRA as a Canada domestic entity and hold $100,000 CAD or more in foreign assets you have to file Form T1135: https://www.canada.ca/en/revenue-agency/services/tax/international-non-residents/information-been-moved/foreign-reporting/foreign-income-verification-statement.html

- Canada has a number of income tax treaties to prevent double taxation: https://www.canada.ca/en/department-finance/programs/tax-policy/tax-treaties.html

For the US Internal Revenue Service:

- If you have signature authority over more than $10,000 USD held in foreign financial institutions, whether you are the owner or the trustee, you have to file FBAR: https://www.fincen.gov/report-foreign-bank-and-financial-accounts

- If you file an income tax return with the IRS as a US domestic entity and hold $50,000 USD or more in foreign financial assets you have to file Form 8938: https://www.irs.gov/businesses/corporations/do-i-need-to-file-form-8938-statement-of-specified-foreign-financial-assets

- The US has a number of income tax treaties with other countries so you won’t necessarily get double taxed on the same income: https://www.irs.gov/businesses/international-businesses/united-states-income-tax-treaties-a-to-z

Utilizing different tax rates

Even if you create a corporation or LLC in another location, this does not mean that all of your income will magically be taxed at the lower rate, but this is not difficult. At a high level:

- Get a street address in another location with Anytime Mailbox or iPostal1, which you will use for your business address and registered agent address. Alternatively, there are plenty of companies that offer these services for you and will manage everything if you pay them higher “all inclusive” fees.

- Create a holding LLC in the low tax jurisdiction. LLCs usually have lower filing fees, less paperwork than C-corporations, nor do you have to pay taxes on the business entity’s earnings and what you elect to pay yourself as your personal income.

- Transfer the ownership of all assets (intellectual, tangible, or otherwise) from your existing business to the new business in the low tax jurisdiction.

- Have the existing business pay significant rent or royalties to the holding company thereby wiping out the tax burden of the existing company. Think about doing this across country borders? Check out the Multi Currency Account from Wise.

- Elect to have the holding LLC taxed as a corporation so all of the profits are retained in the low tax jurisdiction, but beware this might set you up for personal holding company penalties. It might be easier to spend down most of the revenue on an American Express company card and let the remaining profits continue to pass through.

For a deeper example with the state of Wyoming, I highly recommend reading: https://www.northwestregisteredagent.com/start-a-business/wyoming/tax-benefits

Business deductions

Earlier in the course we talked about running your household as a business, more specifically a family office. Managing your family’s wealth then becomes a business and allows us to take advantage of all kinds business deductions for the purposes of keeping your family successful, strong, healthy, and wealthy.

All the legals fees for creating a family business are tax deductions. Maintaining a home office and your virtual office becomes a tax deduction. Telecom services. Paying employees (aka family members). Interest on purchases to increase your family’s wealth. Insurance. Family meetings. The list goes on:

- https://turbotax.intuit.com/tax-tips/small-business-taxes/taking-business-tax-deductions/L5RueYPVS

- https://www.bdc.ca/en/articles-tools/money-finance/manage-finances/tax-deductible-expenses

Just remember you need to show profit in at least 3 of the last 5 years: https://www.thebalancemoney.com/is-this-business-for-real-or-is-it-a-hobby-397675

Practicum

Please contact me at jzerbe@vraidsys.com for assistance in setting up your family wealth office. We will guide you through the exact steps and offer templates for:

- Opening a virtual office

- Filing with the Secretary of State

- Filing with the IRS

- Creating an operating agreement

- Notarizing business documents

- Banking